BIRMINGHAM, England — So in the end, Liz Truss was for turning. But the damage to her faltering administration may already have been done.

On Monday, Truss’ Chancellor Kwasi Kwarteng bowed to pressure from Conservative Party colleagues and dumped his flagship cut to the top rate of tax from 45p to 40p — a central component of last month’s so-called mini-budget.

“We get it, and we have listened,” Kwarteng said as he announced the dramatic U-turn on Twitter.

Later it emerged he will also bring forward an announcement on how the tax cuts will be funded, having initially insisted the public — and the markets — must wait until November 23.

A parliamentary insurrection, which was rapidly gaining pace as MPs met for their annual party conference in Birmingham on Sunday, appears to have been quelled, for now.

Asked if he would now support the mini-budget in parliament following the abandonment of its most controversial measure, rebel ringleader Michael Gove said: “Yeah I think so, on the basis of everything that I know. There were lots of good things that they announced … The debate over the 45p tax increase obscured that.”

The market reaction was also mildly positive, with the bond and currency markets rallying somewhat following the announcement.

But most MPs and delegates in Birmingham believe it will take significantly more than a single U-turn to rebuild the political and fiscal credibility of the fledgling Truss administration, with some MPs fearful a revival is already out of reach.

“She started very poorly, and in my experience, what you see is what you get. People aren’t mysteriously really shit, and then become really good,” one senior Tory MP said.

Pissed-off

While a Tory rebellion appears to have been averted for now, few MPs believe it will be the last Truss faces in the difficult weeks and months ahead.

Even before Kwarteng’s now-infamous ‘fiscal event,’ Truss had plenty of detractors on Conservative benches. Only around a third of her own MPs backed her in the leadership contest, and after taking office she almost exclusively chose loyalists for her ministerial ranks. Those who backed her opponent Rishi Sunak were left out in the cold.

“Her party management has pissed people off,” the senior Tory MP quoted above said, with many of what they described as talented MPs questioning whether it was even worth backing the government in the long-term.

But while the “lightning rod” of the 45p tax rate had now been “neutralized,” according to one minister, backbenchers could soon find another hot topic and “push on that next.”

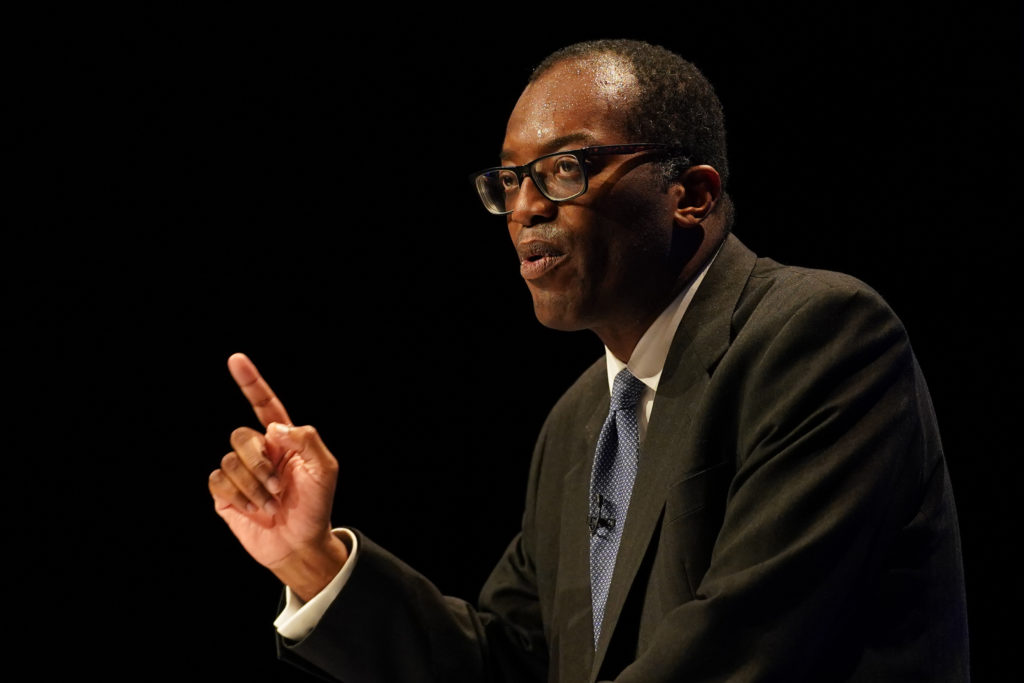

Chancellor Kwasi Kwarteng | Ian Forsyth/Getty Images

Two potential major flashpoints will be the new government’s approach to welfare payments, and funding public services. Ministers are currently undecided over whether to uprate benefits in line with inflation — as pledged by Boris Johnson’s administration — while also dropping heavy hints that cuts to the state are on their way.

The opposition Labour Party, now surging ahead in the polls, see political capital too in Truss’ stated plans to lift the cap on bankers’ bonuses and abandon a hike to corporation tax.

“They’ve still got a totally unfunded £17 billion [corporation] tax giveaway for the wealthiest businesses at a time when people and businesses are struggling with the cost of living.” one Labour official said, in a taste of the messaging Tory MPs will likely be up against at the next election.

Few Tory MPs are optimistic Truss can turn things around.

“Politics works as a pendulum. If it swings towards the middle it’s possible to pull it back. But if it swings too far it can become irreversible,” the minister quoted above said.

Writing for POLITICO, Boris Johnson’s former No. 10 comms chief Lee Cain said it was “unlikely” Truss’ reputation would ever recover.

“It didn’t need to be this way,” he wrote. “Many of the unforced errors could have been avoided if the PM had understood how to talk to the audience that matters most — the electorate.:

Benefit of the doubt

But voters may yet be more forgiving than some of Truss’ critics in the party, according to pollsters and focus group experts keeping a close eye on public opinion.

“We consistently find voters don’t mind a U-turn on an unpopular policy,” said Luke Tryl, director of the More in Common consultancy, which regularly hosts focus groups across the country.

“In fact one of the things we found during the leadership contest was that people quite liked the fact that Liz Truss changed her mind, because they felt that’s what normal people do,” he said.

But he cautioned that while voters don’t mind U-turns as one-offs, “a series of them starts to look chaotic and will worry voters about whether the government knows what it is doing to see the country through the turmoil.”

Fiscal credibility

Crucially, reversing just £2 billion of the proposed £45 billion of unfunded tax cuts seems insufficient, in isolation, to restore trust in the U.K. economy and bring down spiraling interest rates.

“When market trust has been shattered, as we saw last week, the uphill task of restoring credibility is extremely hard and even harder when strategies shift,” Charles Hepworth, investment director at GAM, said.

“The market currently has little faith that the prime minister and chancellor can restore credibility in the short term, and this puts further renewed pressure on U.K. risk assets.”

Neil Birrell, chief investment officer at Premier Miton Investors, agreed the U-turn would not solve the turmoil in financial markets.

“High inflation and high interest rates are not going away quickly, and economic growth is under severe threat,” he said.

“Markets still need to hear how the package will be funded,” added Iain Anderson, executive chairman at H/Advisers Cicero, who said the next fiscal statement planned for November 23 must be brought forward as a matter of urgency.

The first senior Tory MP quoted above lamented that the market turmoil following the mini-budget meant the Tory party would now “own interest rate rises — a lot of which were going to happen anyway.”

“I cannot remember in my life when any politician has recovered from such a savage self-inflicted wound,” Giles Wilkes, a senior fellow at the Institute for Government and partner at Flint Global, said.

“Gordon Brown recovered somewhat from the multiple slip-ups of 2007-08 with his commanding response to the global financial crisis, but even that wasn’t enough.”